IMF upgrades Nigeria’s 2026 growth rate forecast to 4.4%

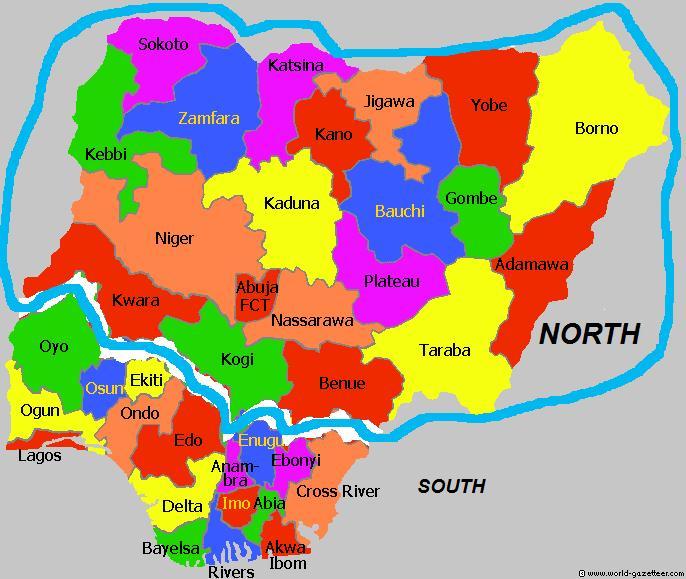

States in Nigeria

Projects global growth to remain resilient at 3.3% in 2026

The International Monetary Fund (IMF) has upgraded its forecast for Nigeria’s economic growth rate upward to 4.4 percent in 2026.

The organisation also projected that global growth will remain resilient at 3.3 per cent in 2026 and at 3.2 per cent in 2027.

The projection is contained in the fund’s latest World Economic Outlook (WEO) update for January released on Monday.

IMF said Nigeria’s economic growth is expected to slow down to 4.1 percent in 2027.

The fund further projected that sub-Saharan Africa’s economy will expand by 4.4 percent in 2026.

According to the organisation, the new growth rate represents an upward review from its October 2025 projection of 3.1 percent in 2026.

IMF said strong technology investment, supportive fiscal and monetary policies, favorable financial conditions, and private sector resilience have helped offset the effects of shifting trade policies.

The fund also said global inflation is projected to decline, though inflation in the United States is expected to return to target more gradually.

The report said that the forecast marked a small upward revision for 2026 and no change for 2027 compared with that in the October 2025 WEO.

According to the report, this steady performance on the surface results from the balancing of divergent forces.

“Headwinds from shifting trade policies are offset by tailwinds from surging investment related to technology, including artificial intelligence (AI), more so in North America and Asia than in other regions.”

The report also cited monetary support, broadly accommodative financial conditions, and adaptability of the private sector.”

It said that global headline inflation was expected to decline from an estimated 4.1 per cent in 2025 to 3.8 per cent in 2026 and further to 3.4 per cent in 2027.

“The inflation projections are also broadly unchanged from those in October and envisage inflation returning to target more gradually in the United States than in other large economies.”

The report said that among advanced economies, growth was projected to be 1.8 per cent in 2026 and 1.7 per cent in 2027.

For emerging markets and developing economies, it projected growth to continue to hover just above 4.0 per cent in 2026 and 2027.

It projected growth in the Middle East and Central Asia to accelerate from 3.7 per cent in 2025 to 3.9 per cent in 2026.

The report projected 4.0 per cent accelerated growth in 2027, supported by higher oil output, resilient local demand and ongoing reforms.

The report said that for Sub-Saharan Africa, growth was expected to also accelerate from 4.4 per cent in 2025 to 4.6 per cent in 2026 and 2027.

It said the growth in the region would be supported by macroeconomic stabilisation and reform efforts in key economies.

“In Latin America and the Caribbean, growth is expected to moderate to 2.2 per cent in 2026 and bounce to 2.7 per cent in 2027 as countries in the region approach potential from different cyclical positions.

“In emerging and developing Europe , a sharp slowdown in 2025 to a growth rate of 2.0 per cent is expected to reverse.

“Economies in the region will expand at an average rate of 2.3 per cent in 2026 and 2.4 per cent in 2027,” it said.

The report said that risks to the outlook remained tilted to the downside, which were revaluation of technology expectations and escalation of geopolitical tensions.

On the upside, the report said that activity could be further lifted by AI-related investment and eventually transform into sustainable growth if faster AI adoption translates into strong productivity gains and increased business dynamism.

“Activity could also be supported by a sustained easing in trade tensions.”

The reports recommended that policymakers should restore fiscal buffers, preserve price and financial stability, reduce uncertainty, and implement structural reforms without further delay.